Learn more

Make sure your packaging isn't contributing to the loss of Australia's native forests

Cardboard packaging is everywhere. From online shopping to pizza deliveries, many of the products we buy are packaged and transported in cardboard. It’s easy to assume that this cardboard is recycled and has minimal environmental impact. But is this really the case?

Victoria’s magnificent tall forests are largely being logged and pulped for the packaging and paper industry.

Much of this demand is fuelled by a single company: paper and packaging manufacturer Opal, which is owned by Japanese conglomerate Nippon Paper. It is likely that you’ve used packaging produced by Nippon / Opal, and there’s a high risk that this packaging is contributing to the destruction of our precious native forests.

To ensure the survival of Australia’s native forests, Nippon / Opal and other companies like it must cease pulping native forest wood and transition fully to more sustainable alternatives. We can help make this happen by calling on companies that use packaging to do the right thing: reject manufacturers like Opal that are driving the destruction of native forests.

Discover Victoria’s tall forests, critical habitat for endangered species like the greater glider. (Main image top: logged mountain ash, Justin Cally)Logging destroys habitat and drives our unique flora and fauna closer to extinction. Victoria’s Mountain Ash forests are red-listed as a Critically Endangered ecosystem, and home to creatures like the Endangered Greater Glider and Critically Endangered Leadbeater’s Possum.

Logging can increase bushfire risk, as logged forests burn more fiercely than intact forests.

Logging is bad for the climate. It generates significant lifecycle greenhouse gas emissions and destroys some of the most carbon-dense forests in the world.

Logging reduces water quantity and quality, putting our water supply at risk.

Current legislation and forest management planning poorly recognise the rights of First Nations.The rights and interests of First Nations should be recognised in all aspects of land and water management, as well as decision making in relation to forests on their traditional lands under the principles of free prior and informed consent.

Given these issues, and given that alternatives such as plantations and recycled materials are already in use, why are Victoria’s high conservation value native forests still being logged? And how is packaging part of the problem?

Nippon / Opal is supplied with native forest wood by state-owned logging agency VicForests in accordance with a piece of legislation called the Forests (Wood Pulp Agreement) Act 1996. The Act provides for a guaranteed supply of wood from public forests to Opal’s Maryvale Mill facility, where woodchips from logged forest are pulped and processed to make paper and packaging.

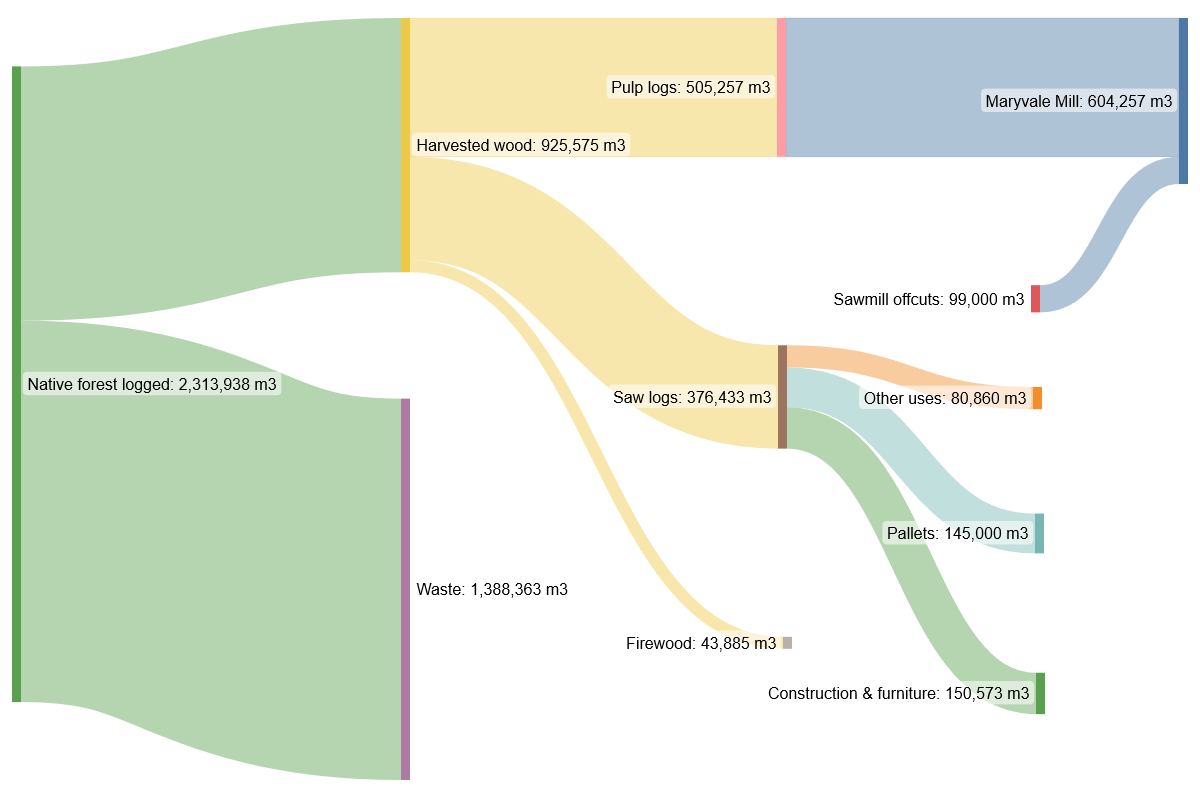

VicForests’ sales figures indicate that, by volume, more than half1 of the native forest wood it sells is ‘pulplog’, which is used in the manufacture of paper and packaging. All of this pulplog sales volume (more than 500,000 cubic metres per year) can be accounted for in existing supply agreements with Nippon / Opal.

The Wood Pulp Agreement Act specifies a guaranteed minimum supply of 350,000 cubic metres of native forest wood to Maryvale Mill, and the more recent Timber Sales Agreement 2005 adds a further 200,000 cubic metres of native forest wood on top of this.

This total of 550,000 cubic metres of supply aligns closely with the actual sales figures VicForests publishes in its annual reports, showing that Nippon / Opal is by far the major buyer of pulpwood from VicForests.

Meeting Nippon / Opal’s pulplog demands alone requires the logging of an area of native forest roughly equivalent to 680 MCGs per year2. Wood for uses such as construction and furniture represents a much smaller fraction of the total demand for native forest wood in Victoria, with around 14% of wood extracted by VicForests sent to sawmills for these purposes.

The processing of this wood generates waste (or ‘offcuts’), which are also sent to Maryvale Mill. On top of its pulplog consumption, Maryvale Mill consumes around 99,000 cubic metres of sawmill offcuts per year to manufacture paper and packaging.

Historically, much of the focus on Opal (which was formerly named Australian Paper) has centred around its use of native forest wood to manufacture office papers, most notably its flagship brand, Reflex. Until recently, there has been less scrutiny on the packaging side of Opal’s business. But this is changing.

Opal’s packaging business is an area of growth and strategic focus for Nippon. In 2019, Nippon acquired packaging manufacturer Orora for $1.7 billion, integrating its business into the Opal brand. This move made Opal one of the largest players in fibre-based packaging manufacturing in Australia.

This shift in focus to packaging should be a cause for alarm given what is known about the native forest wood inputs that feed Opal’s Maryvale Mill facility. Opal’s ‘Neutral Sulphite Semi Chemical’ (NSSC) mill at Maryvale (one of three paper mills at the facility) takes woodchips from mixed species native forest as an input and produces unbleached pulp as an output. This pulp is used to manufacture packaging3.

More specifically, it is likely that the pulp from this mill is used to make what is referred to in the industry as ‘kraft linerboard’, a type of heavy unbleached paper that is used to make cardboard boxes. Opal states on its website that it is a major supplier of kraft linerboard and documents indicate that prior to the 2019 acquisition, Opal was already supplying kraft linerboard to Orora, which Orora used to manufacture cardboard boxes.

Companies like Nippon / Opal must stop pulping Australia’s forests and complete the transition to using plantations and recycled fibre. Taking this step will maintain jobs and secure the long-term future of the industry, which is running out of wood because native forests have been over-logged, badly managed, and burnt in bushfires.

Companies, especially those that buy large amounts of packaging, should avoid buying from Opal until Opal, and its parent company Nippon, confirms that it does not and will not use native forest fibre to manufacture paper and packaging. Companies that take their sustainability responsibilities seriously should also introduce policies to prevent the purchase of any products that cause the logging and destruction of native forests.

But what if you’re not a decision maker at a big company that buys tonnes of packaging? You too can make a difference by letting the companies you buy from know that what goes into the packaging they use matters to you, and that you expect them to take steps to source packaging ethically. These are some things to look for, and questions to ask:

Does your company buy packaging manufactured by Opal?

Does your company have a policy in place that prevents the purchase of products that contribute to the destruction of native forests?

The FSC 100% and FSC Recycled labels provide assurance that the product does not contain wood fibre from the destruction of native forest. Unfortunately, the FSC Mix label does not provide this same assurance. Learn more about the FSC labels and forest product certifications.

The Responsible Wood and PEFC labels should not be relied on as indicators that a product is native forest destruction free.

Across Australia, companies like Nippon / Opal continue to take a cavalier approach towards the environment because they believe they can get away with it, relying on a lack of transparency and public awareness.

By understanding the issues outlined above, and by calling on manufacturers and companies in the supply chain to clean up their act when it comes to sustainable packaging, we can show the industry that it must do better. Let’s make these companies understand that destroying native forests is not only bad for the environment—it’s bad for business.

Harvested wood volume (925,575 m3) is derived from VicForests’ 2021 annual report, which reports sales volumes for the 2020-21 financial year.

Pulp logs, saw logs, and firewood volumes are from VicForests’ 2021 annual report, which reports sales volumes for the 2020-21 financial year.

Waste (1,388,363 m3) is derived by dividing VicForests’ 2020-21 harvested wood volume (925,575 m3) by 40% to get a wood volume of 2,313,938 m3 for total native forest logged, then multiplying again by 60% (the proportion of logged native forest left as waste). Only 40% of forest biomass from logged forest is removed; the remaining 60% is debris / waste. Source: The Conversation (2019): Logged native forests mostly end up in landfill, not in buildings and furniture.

Pulplog sales to Maryvale Mill (505,257 m3) is assumed to essentially account for VicForests’ FY 2020-21 pulplog harvest. Pulplog sales to other buyers, including overseas buyers, are assumed to be minimal given that VicForests’ FY 2020-21 pulplog sales volumes of 505,257 m3 were below its total supply commitments of 550,000 m3 as per the Wood Pulp Agreement Act (350,000 m3 / year) and the Timber Sales Agreement 2005 (200,000 m3 / year).

Sawlog sales for construction and furniture (150,573 m3) is derived by multiplying total VicForests sawlog sales for FY 2020-21 (376,433 m3) by 40%. Approx 40% of sawlogs are of construction / furniture grade and are sent to sawmills for processing. The remaining 60% are processed for other uses, including pallets. Sources: The Conversation (2019): Logged native forests mostly end up in landfill, not in buildings and furniture, VEAC (2017): Fibre and Wood Supply Assessment

Sawlog sales for pallets (145,000 m3) is based on the estimate that VicForests supplies pallet manufacturer ANWE approximately 145,000 tonnes of wood for pallet manufacturing (it is assumed that 1 cubic metre of wood weighs approximately 1 tonne). Source: Affadavit of Malcolm McComb, Chairman of Pentarch, given as evidence in Environment East Gippsland v VicForests. Dated 3 December 2021.

Sawlog sales for other uses (80,860) is derived by subtracting the estimated sawlog sales for construction and furniture (150,573 m3) and for pallets (145,000 m3) from VicForests’ total sawlog sales in FY 2020-21 (376,433 m3).

Sawmill offcuts (99,000 m3): is an estimate derived from figures in Opal’s 2018 Sustainability report.